Definition of Irrational ExuberanceOrigin of the Term

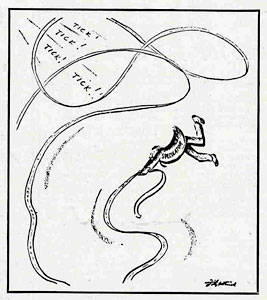

Immediately after he said this, the stock market in Tokyo, which was open as he gave this speech, fell sharply, and closed down 3%. Hong Kong fell 3%. Then markets in Frankfurt and London fell 4%. The stock market in the US fell 2% at the open of trade. The strong reaction of the markets to Greenspan's seemingly harmless question was widely noted, and made the term irrational exuberance famous. It would seem to make no sense for markets to react all over the world to a question casually thrown out in the middle of a dinner speech. Greenspan probably learned once more from this experience how carefully someone in his position has to choose words. As far as I can determine, Greenspan apparently never actively used the words "irrational exuberance" again in any public venue. The stock market drops around the world that occurred after his speech on December 6, 1996 have all been forgotten, eclipsed by bigger subsequent events, but it was those stock market drops that focused public attention on the phrase irrational exuberance and which caused it to enter our language. The term irrational exuberance became Greenspan's most famous quote, out of all the millions of words he has uttered publicly. The term "irrational exuberance" is now often used to describe a heightened state of speculative fervor. It is less strong than other colorful terms such as "speculative mania" or "speculative orgy" which discredit themselves as overstating the case. I chose this phrase as the title for my book because many people know instantly from this title what this book is about. Often people ask me whether I coined the term irrational exuberance, since I (along with my colleague John Campbell and a number of others) testified before Greenspan and the Federal Reserve Board only two days earlier, on December 3, 1996, and I had lunch with Greenspan on that day. I did testify that markets were irrational. But, I feel sure that I am not the origin of the words irrational exuberance. Actually, Greenspan is quoted in a Fortune Magazine article in March 1959, long before he became Federal Reserve chairman, about "over-exuberance" of the financial community. These are similar words. It appears that "irrational exuberance" are Greenspan's own words, and not a speech writer's. In his 2007 autobiography, The Age of Turbulence: Adventures in a New World Greenspan said "The concept of irrational exuberance came to me in the bathtub one morning as I was writing a speech." (p. 176.) A computer search finds that the phrase "irrational exuberance" had virtually never been used before Alan Greenspan. It has been pointed out to me that the words "irrational exuberance" were used in a 1989 novel A Trap for Fools by Amanda Cross, E. P. Dutton, NY, Chapter 8, p. 99, ". . . she didn't just tumble out of that window in a moment of irrational exuberance," but this was a very rare exception. But, the term did not spring full-born from the soul of Alan Greenspan either, for there were already common uses of the words individually to refer to speculative market excess. As early as 1931, Frederick Louis Allen, in his best seller Only Yesterday: An Informal History of the 1920s described "the profound psychological reaction from the exuberance of 1929." (p. 285). Two years before Greenspan's speech, an editorial in Business Marketing by Rance Craine contained the paragraph "The stock market has been behaving in a seemingly irrational way most of the year. Every time the Commerce Department puts out fresh data showing that the economy continues to strengthen, the stock market goes down in a dramatic fashion. And when retail or car sales go down, or factory orders slow from the previous month, the stock market can hardly contain its exuberance." I believe that there is nothing essentially catchy about the phrase "Irrational Exuberance," but it lives on because the initial 1996 story of a stock market crash by nothing more than the utterance of those words led to a general interest in the phrase. The phrase survives in our language as more than a relic of one minor stock market episode because it has acquired a meaning that refers to the mindset that occurs during speculative bubbles like that of the 1990s. Robert J. Shiller

|

The term

"irrational exuberance" derives from some words that Alan Greenspan, chairman of the Federal Reserve Board in

Washington, used in a black-tie dinner speech entitled

The term

"irrational exuberance" derives from some words that Alan Greenspan, chairman of the Federal Reserve Board in

Washington, used in a black-tie dinner speech entitled